Frequently Asked Questions

Get your facts and questions answered here

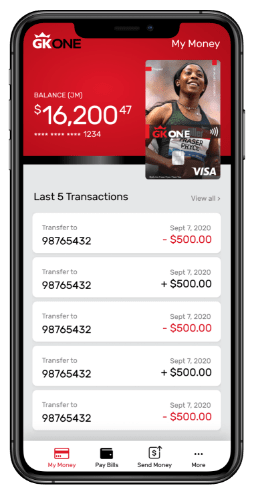

What is the GK One Mobile App?

The GK One mobile app is a digital convenient, secure all-in-one access point to the Grace Kennedy financial suite of products.

How do I get the GK One App?

Download the app for free from the Google Play Store.

What can I do with the GK One App?

The GK One mobile app provides you with a digital avenue to send remittances, receive

remittances and pay bills.

Do I need data/Wi-Fi to use the GK One App?

No, we’ve made the GK One mobile app available to you for FREE. No need to worry about data charges or Wi-Fi access.

How is my Wallet different from my pre-paid card?

Your GK One wallet is linked to your pre-paid card. However, they differ in that the pre-paid card is a physical card that can be used primarily to carry out manual transactions such as withdrawing cash from an ATM and conducting POS transactions. The GK One wallet, is a virtual card that is used to carry out online transactions related to GK One financial services, that is, sending and receiving remittances and making bill payments via BillExpress.

How do I get a GK One wallet?

You can acquire a GK One Wallet by downloading the GK One Mobile App from the Google Play Store then registering for the Wallet by completing KYC requirements outlined in the app.

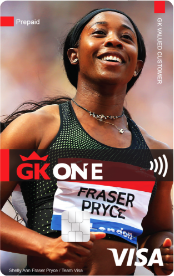

How do I sign up for a GK One Pre-paid card?

Sign up for your free GK ONE prepaid VISA Card by downloading the GK One mobile app from the Google Play Store.

How do I add funds to my GK One Pre-paid card?

Currently, only by way of receiving a WU remittance.

What can I do with my GK One wallet?

You can use your GK One wallet to make bill payments via BillExpress, receive and send remittances.

What can I do with my GK One Pre-paid card?

You can use your pre-paid card to; Withdraw funds from an ATM machine where VISA cards are accepted, make purchases at any POS machine where VISA cards are accepted and Shop online. You can also use your pre-paid card to make bill payments, send and receive remittances through the GK One app.

How do I expand my GK One pre-paid card transaction limit?

To expand your transaction limit, you will be required to upload a photo of your proof on income. This can take the form of;

A Job letter confirming salary / Pay Slip / Work ID / Audited accounts/Income Tax Return Form (S04) (if self-employed) / Financial Statement / Trade/Business license / Payment receipts (Services or goods sold) / Business documents e.g. Certificate of Registration/Incorporation / Service Contract / Sale/Rental Agreement / Sale/rental receipts / Letter from lawyer / Letter from Real Estate agent.

Why do you need to verify my identity?

As an added layer of protection for your account, we’ll use this information to build your customer profile with us. This way if we spot an unusual transaction we can alert you quickly and help you to protect your money.

How will you verify my identity?

When registering, each customer is required to complete the KYC process, that

information will be used to verify your identity.

I’ve forgotten the passcode to my GK One mobile app, how do I reset it?

There is a feature in the GK One app that will guide you through resetting your

password. You can initiate this action by clicking the ‘forget password’ option.

I have forgotten the PIN for my pre-paid card, what should I do?

Contact the customer service center at (876)-733-7722 or visit the location you had your card pinned.

What is GK One?

The GK One mobile app is a convenient, secure all-in-one digital access point to the GraceKennedy financial suite of products.

How do I get the GK One app?

Download the app for free from the Google Play Store or the App Store

What can I do with the GK One app?

The GK One mobile app provides you with a digital channel to:

– Sign up for your Prepaid Visa card

– Receive Western Union money transfers

– Pay bills

– And earn rewards!

Do I need data/Wi-Fi to use the GK One digital wallet?

Currently yes, you do need data/Wi-Fi to use the app.

How do I sign up for a GK One Prepaid card?

Sign up for your free GK One prepaid VISA Card by downloading the GK One mobile app

from the Google Play Store or the App Store- all you need is a valid Jamaican

government-issued ID and TRN

How is my wallet different from my prepaid card?

Your GK One wallet is linked to your prepaid card. However, they differ in that the pre-

paid card is a physical card that can be used to shop online, in stores and get cash from

any ABM locally or internationally that accepts VISA while your digital wallet, allows you

to spend, save and manage your money from the app.

How do I get a GK One digital wallet?

Sign up for your free GK One digital wallet and prepaid VISA Card by downloading the GK

One mobile app from the Google Play Store or the App Store- all you need is a valid

Jamaican government-issued ID and TRN

Is there a cost to use the GK One prepaid card?

There is no fee to sign up or store your funds on your GK One Card! Fees are only charged

when using ATMs and if your transaction declines due to insufficient funds.

How do I add cash to my GK One digital wallet??

Add cash to your GK One account by receiving a WU Money Transfer in app, in store at

the WU window or over the counter at select BillExpress locations island wide.

How do I check my GK One pre-paid card balance?

You can check your prepaid card balance by viewing your transaction history in the GK

One mobile app, enquiring at the ATM or by calling Customer Support Center at (876)-

733-7722

I’ve forgotten the passcode, how do I reset it?

There is a feature in the GK One app that will guide you through resetting your

password. You can initiate this action by clicking the ‘forget passcode’ option.

I have forgotten the PIN for my prepaid card, what should I do?

Contact the Customer Support Center at (876)-733-7722 or visit the location you had

your card pinned.

What should I do if the GK One mobile app is unresponsive?

Close the app and clear it from your ‘open tabs menu’, then relaunch the app. If the app

is still unresponsive, Customer Support Center at (876)-733-7722 and seek their

assistance in you carrying out the transaction you wanted to initiate through the app.

What should I do if my card is faulty or expired?

Contact the Customer Support Center at (876)-733-7722

Why do you need to verify my identity?

As an added layer of protection for your account, we’ll use this information to build your

customer profile with us. This way if we spot an unusual transaction, we can alert you

quickly and help you to protect your money.

Do I need to sign up for Western Union Direct to Bank to receive remittances via GK One?

No, you don’t need to sign up for Direct to Bank to use the GK One app

I already have Direct to Bank; can I still use the GK One mobile app to send or receive money?

Yes, you can! Simply sign up with the GK ONE app, using your ID and TRN and you can receive your next money transfer in the app, directly to your GK ONE Prepaid Visa Card.

Is there a limit to the cash value I can receive to my GK One digital card?

Yes, for your security there is a card limit of J$100,000, daily transaction limit of J$100,000, daily ATM withdrawal limit of J$30,000 and monthly account/card limit of J$200,000.

Can I send money transfers using my GK One digital card?

Look out for upgrades. This feature is coming soon!

How will I know that my friend/family member has received my money transfer?

The transaction status will be updated in the app.

What happens if I don’t know my MTCN?

Your MTCN is required for all Western Union transfers, please ensure you request this number from the sender as transfer cannot be completed without this information.

What currency will I receive to my wallet?

Your local currency –JMD

Why do you need to know my source of funds?

The source of funds is a regulatory requirement to verify that the funds being used are from a legitimate source.

What happens if my IDs expire?

You must have a valid ID to conduct business. Transactions cannot be processed with an expired ID

Is there a fee to pay my bills using the GK One digital wallet app?

No, its FREE to pay your bills via GK One mobile app.

Which bills can I pay using the GK One digital wallet?

You can make payment to all billers listed with BillExpress.

What do I need to pay my bills using the GK One app?

All you need is your biller account number.

What payment methods can I use to pay my bills using the GK One digital wallet?

You can use your GK One digital wallet to pay bills in the app.

Am I only allowed to pay my own bills using the GK One digital wallet?

No, you can pay any bill you have the Biller Account Number for.

Is there a limit to the amount I can pay on any bill?

Yes, some billers have restrictions on how much you can pay per bill.

How soon after making payments using the GK One digital wallet are my accounts updated with the biller?

Update times range from 30 minutes to 24 hours depending on the biller’s operational hours.

What happens if a biller says “Cash only”?

You will have to use your GK One digital wallet to make payment

How can I confirm that payment has been made?

You are able to download, save and share your receipt.

How can I confirm that the Biller has received my payment?

Check with Biller, your GK One digital wallet receipt serves a proof of payment for your interactions with biller.

Can I cancel a payment made in the GK One digital wallet?

Payments can only be cancelled by contacting BillExpress at 888-555-5555.

Can I schedule automatic payments for my bills?

Yes, you can. Never miss another due date with GK ONE!

How do I cancel the Auto Pay feature?

You may deselect the auto pay feature by editing any of your favorite billers.

How do I access my bill payment history?

Transaction history from the last 30 days will be available from the home screen. For older transactions, you can contact BillExpress at 888-555-5555.

Who can apply for a credit card?

Any employed individual 18 years of age or older can apply for a credit card through the GK One mobile app.

Which credit cards are being offered through the GK One mobile app?

- First Global Bank Visa Classic card

- First Global Bank Visa Gold

Why can’t I apply for the any other credit card product through the GK One mobile app?

FGB is not currently offering any other products such as the Affinity and Platinum Cards through the GK One App. When we do, we will be sure to make a big deal about it!

What the minimum income I must have to apply for a FGB Classic or Gold credit card?

- Classic credit card: J$50,000.00 per month

- Gold credit card: J$350,000.00 per month

What are the benefits of the FGB Visa Classic credit card?

- Access to the FGB Rewards Program

- virtual card for online shopping

- Travel Accident Insurance (free coverage up to $75,000 USD)

- Split/Share Limit Card

What are the benefits of the FGB Visa Gold credit card?

- Access to the FGB Rewards Program

- virtual card for online shopping

- Travel Accident Insurance (free coverage up to $250,000 USD)

- Split/Share Limit Card

Can I own both the FGB Classic and Gold credit cards?

Yes, you can!

Can I own two of the same type of credit cards (i.e, two classic or two gold credit cards?

No, you cannot. Any attempt to do so will result in a declined application.

What are the minimum requirements to get a credit card through the GK One mobile app?

To apply for a credit card through the GK One mobile app, you must provide the following:

- Proof of ID in the form of either a Driver’s License or a Voter’s ID

- Proof of Address (Utility Bill, Letter from a JP)

- Proof of Income (Pay slips, Job letter, Bank Statements)

What are the interest rates for the cards offered through the GK One mobile app?

The Visa Classic Card has an interest rate of: 48.85%

The Visa Gold Card has an interest rate of: 48.50%

Can I use pictures of my documents as proof of address?

Yes, you will be able to upload pictures of your documentation to satisfy the requirements for proof of address and proof of income. The app will also accept files in the formats: .pdf, .doc, .docx, .xls, .xlsx, .jpg, .png and .jpeg

What is considered as valid proof of identification for my FGB Credit Card application?

If you’re using the GK One App to apply for a credit card, you can use either of the following:

- Driver’s License

- National (Voter’s) ID

Why can’t I use my passport as valid proof of identification?

Unfortunately, the GK One Application does not currently support the use of passports as valid proof of identification.

How long will my application take to process?

Your application can take up to two business days to process.

How will I know whether my credit card application has been approved or denied?

You will be able to track your application via the GK One mobile app. Additionally, you will get notifications regarding any changes in your application status.

If my application is approved, how will I get my credit card?

Your credit card will be delivered to the address you would have entered earlier in the application process.

How long after applying does it take for me to get the card?

Your application will take up to two business days for approval thereafter 5-10 business days for the card to be delivered to the branch so that’s 7-12 business days in total, once your application has been approved.

Can I activate my credit card in the GK One Mobile app if I did not apply through the app?

Yes! Sign up for the app, select the credit card option and select the “Activate Card” option from the credit card menu. Follow the instructions on screen to activate your card.

Will my information be saved if I log out without finishing an application?

No, once you log out or if the session times out, your ID information will remain in a validated state however, the information you’ve entered will not be saved, you will have to redo the application form.

Can I apply again if my application gets denied?

Yes, you will be able to apply for any of the credit card products offered through the GK One app if there are no active/open applications for you at the bank.

What if I notice an unauthorized transaction on my card?

If you have access to our online banking platform, you should immediately block the card and then contact our Customer Care Centre at 888-CALL-FGB (1-888-225-5342) for further assistance.

My card was lost/stolen, what do I do?

You should immediately restrict the card using our online banking platform and then contact our Customer Care Centre at 888-CALL-FGB (1-888-225-5342) for a replacement.

Telephone:

(876) 733-7722

How do I earn rewards?

All you need to do is Refer & Earn rewards for each friend or family member you get to sign up for a FREE GK One Prepaid Visa Card.

a. Sign up for your GK One Prepaid Visa Card in the GK One mobile app

b. Tap Rewards to link your existing or create a new GK Value Rewards (GKVR)

account in seconds

c. Share your unique Referral Code with friends and family for them to sign up for

a free GK ONE Prepaid Visa Card

d. Stack your REWARDS!

What rewards can I redeem my points for?

Redeem rewards points with almost 200 partners with gift cards from Amazon, local restaurants, gas retailers, hotel getaways and so much more. View the Rewards Catalogue here

(https://www.gkvaluerewards.com/rewards?sort=none&category=all)

What is GK Value Rewards?

The GraceKennedy Value Rewards (GKVR) is a loyalty programme designed to give back to you, our valued customers. It is our way of saying thank you for choosing to do business within the GraceKennedy Group. We treat you to exclusive rewards whenever you shop at or do business with any of our participating brands: Hi-Lo, GK Insurance, First Global Bank, Bill Express and FX Trader and now, referrals to the GK ONE Mobile App!

I don’t have a GK Value Rewards account can I sign up in the GK One app?

Yes, it’s easy to sign up and takes 2 minutes

I already have a GK Value Rewards account. Can I link to GK One to earn?

Yes, it’s easy to link your account- all you need is your GKVR Member Number & Password

Is there a limit on how much I can earn from referrals?

You can earn UNLIMITED Rewards from referring friends and family to the GK One Mobile App! Get started right away – download in your local app store and sign up today

Can I start earning right away?

Yes! Sign up for your GK One Prepaid Visa Card in the GK One Mobile App, link or create a GK Value Rewards account and share your referral code.

How do I redeem my rewards?

To redeem rewards, visit the GKVR website at www.gkvaluerewards.com

How soon after I sign up for my GK ONE Prepaid Visa Card can I benefit from a signup/bonus code?

Redeem your signup bonus code within 3 days of signing up for your GK One Prepaid Visa Card

Get your GK ONE VISA PREPAID CARD today

Download the app from the Google Play Store and keep track of your money with ease.

Get Your GK ONE Card Too!

Download the app today to sign up for your GK One Prepaid Card and see how wonderful the world of cashless can be.